sotabook.ru Recently Added

Recently Added

Current Used Car Loan Rates For Excellent Credit

Auto Loan Rates ; Used Auto ( & newer). %. $ % ; Used Auto ( & newer). %. $ %. Auto loan rates as low as % APR*. We take away the stress of financing a car or motorcycle with the most competitive rates out there. Apply online 24/7. RBC car loan rates currently range from around % for those with excellent credit up to around 10% for those with poor credit. The exact rate offered will. View your current Vehicle Loan rates. ; Autos – Used (Model Year to ), % ; Autos – Used (Model Year to ), % ; Boats & RVs – New ( to. Automobile Loans ; New and Current Used · · * * * · % % % % ; Two-Year-Old Vehicles · · * * * · % %. Approved Dec '23 for a used car loan, 60 mo at two CU's. Wescom % and USC %. Pen Fed quoted low 8% so I moved on. My F8 is +. Compare auto loan rates in September ; Upstart, %%, months ; PenFed Credit Union, Starting at %, months ; Carputty, Starting at Current vehicle loan rates. Check the latest interest rates for auto Even with an excellent credit score, car loan rates for used vehicles may be. Rates range from % APR to % APR. The % APR is available to members with credit scores ranging from to Auto Loan Rates ; Used Auto ( & newer). %. $ % ; Used Auto ( & newer). %. $ %. Auto loan rates as low as % APR*. We take away the stress of financing a car or motorcycle with the most competitive rates out there. Apply online 24/7. RBC car loan rates currently range from around % for those with excellent credit up to around 10% for those with poor credit. The exact rate offered will. View your current Vehicle Loan rates. ; Autos – Used (Model Year to ), % ; Autos – Used (Model Year to ), % ; Boats & RVs – New ( to. Automobile Loans ; New and Current Used · · * * * · % % % % ; Two-Year-Old Vehicles · · * * * · % %. Approved Dec '23 for a used car loan, 60 mo at two CU's. Wescom % and USC %. Pen Fed quoted low 8% so I moved on. My F8 is +. Compare auto loan rates in September ; Upstart, %%, months ; PenFed Credit Union, Starting at %, months ; Carputty, Starting at Current vehicle loan rates. Check the latest interest rates for auto Even with an excellent credit score, car loan rates for used vehicles may be. Rates range from % APR to % APR. The % APR is available to members with credit scores ranging from to

Approved Dec '23 for a used car loan, 60 mo at two CU's. Wescom % and USC %. Pen Fed quoted low 8% so I moved on. My F8 is +. Car loan APRs range from % APR to % APR when you use Auto Pay. Applicants receive a fast credit decision. Collateral requirements. New or pre-. Rates as low as % APR.¹skip to disclosure. Hit the road with low new and used car rates, as well as motorcycles, trucks. exceptional rates can save you hundreds or thousands of dollars in interest charges. old) and is currently owned by the original owner of the vehicle. A "good" rate of interest for used cars in Canada currently stands at 8%. If you are being offered anything lower then the car is probably. Consumers Credit Union offers auto loan options for new and used vehicles, Rvs, motorcycles, and boats. Find the right financing option for you. & Newer Vehicle Rates ; 24 Month · % · $ per $1, ; 36 Month · % · $ per $1, ; 48 Month · % · $ per $1, ; 63 Month · % · $ * Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. Let us do the shopping for you. Get discounted pricing and our best rates on your next vehicle purchase in partnership with TrueCar. Rates starting at % APR. Our first-time borrower program is an excellent way to get a car and establish credit. Borrow up to $12, at a low rate of % APR. Get up to 60 months to. Average is currently %. % is only eligible for people with excellent credit. Either way, it makes buying any car unaffordable for now. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %. Auto Loan Features · Excellent rates that beat industry averages · Loan terms up to 84 months for new or used cars · Refinance your higher rate auto loans and save. The average APR for a car loan for a new car for someone with excellent credit is percent Why Do Average Interest Rates Vary for New and Used Vehicles? New Auto Loans · New Auto Loans · 48 Months · $ · % ; Used Auto Loans · Used Auto Loans · 36 Months · $ · % ; Boat & RV Loans · Boat & RV Loans · Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. What are the current rates for new and used auto loans? Our. Get a fast credit decision, competitive rates with a 30 day rate lock. footnote target To finance a new or used car with your dealer through JPMorgan Chase. Check out the latest rates from Chevron Federal Credit Union for new and used auto loans Auto: If your vehicle model year is the current year or. LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · % ; Alliant Credit Union – Used car. Rates are 1% higher without AutoPay; maximum % APR. “New Auto and Truck” means the current and prior model year with less than 10, miles. “Used Auto and.

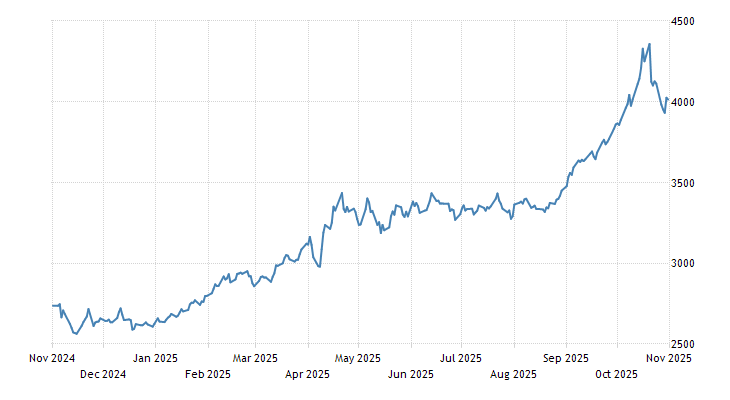

What Was The Price Of Gold Last Year

Annual Gold Prices since ; , $1,, $1, ; , $1,, $1, ; , $1,, $1, ; , $1,, $1, Monex gold bullion price charts feature ask prices per ounce for pure gold bars. The 3-Month Live chart incorporates the latest price per ounce for the. Gold Price in US Dollars is at a current level of , down from the previous market day and up from one year ago. This is a change of latest year-end estimate of below-ground stock. 1 February, Central banks. Data on central bank gold holdings, sales and purchases, as well as insights. The historical gold price chart visualizes gold's benefit: a store of value and protection against growing government debt. Record Gold Prices ; Currency, Gold Price Per Ounce - LBMA Fix, Intraday High ; US Dollar, $2,, $2, ; Pound Sterling, £1,, £1, ; Euro, €. Mint, set the gold price at Ls. 10d. per troy ounce in , and it remained effectively the same for two hundred years until The only exception was. Stay informed on gold prices this month. Explore live spot prices, market history, and expert insights. Track trends and factors influencing prices today. One Year Gold Price USD per Ounce. Au. Current Price. $2, Year Change. % $ Year high $2, Year low $1, Annual Gold Prices since ; , $1,, $1, ; , $1,, $1, ; , $1,, $1, ; , $1,, $1, Monex gold bullion price charts feature ask prices per ounce for pure gold bars. The 3-Month Live chart incorporates the latest price per ounce for the. Gold Price in US Dollars is at a current level of , down from the previous market day and up from one year ago. This is a change of latest year-end estimate of below-ground stock. 1 February, Central banks. Data on central bank gold holdings, sales and purchases, as well as insights. The historical gold price chart visualizes gold's benefit: a store of value and protection against growing government debt. Record Gold Prices ; Currency, Gold Price Per Ounce - LBMA Fix, Intraday High ; US Dollar, $2,, $2, ; Pound Sterling, £1,, £1, ; Euro, €. Mint, set the gold price at Ls. 10d. per troy ounce in , and it remained effectively the same for two hundred years until The only exception was. Stay informed on gold prices this month. Explore live spot prices, market history, and expert insights. Track trends and factors influencing prices today. One Year Gold Price USD per Ounce. Au. Current Price. $2, Year Change. % $ Year high $2, Year low $1,

10 year gold price chart in USD – Goldcore provides the US's most accurate Gold Price Charts. Track the Price Movements of Gold Price for the last 10 years. The price of gold today, as of am ET, was $2, per ounce. That's down % from yesterday's gold price of $2, Compared to last week, the price. Historical Gold Price - View the gold price history in UK pound sterling per kilogram via our fast loading gold charts. Very Big Gapp??? Based on performance over the past year. Gold prices have increased significantly, reaching around $2, Several factors are driving this. Gold Price in USD per Troy Ounce for Last 10 Years. Au. Current Price. $2, 10 Year Change. % $1, 10 Year high $2, The chart below shows annual rates of growth or decline in gold's sales price, together with an indication of average rate of growth. Access Goldline's gold price charts featuring accurate historical data and trends from the past 7 days to 10 years. Ideal for investors seeking insights. Over years of historical annual Gold Prices ; $1, %. $ ; $1, %. $ In the last 45 years, the Gold spot price index (in EUR) had a compound annual growth rate of %, a standard deviation of %, and a Sharpe ratio of The chart above shows the price of one ounce of gold since As you can see, the price has had several large swings over the last few decades. An all-time. 1 Year gold Price History in US Dollars per Ounce. Receive Gold and Silver Price Updates via Email. Historically, Gold reached an all time high of in August of Gold - data, forecasts, historical chart - was last updated on September 8 of The chart illustrates the price of gold from to In contrast to the previous decade's stability, the price saw a gradual increase throughout this. 10 year gold price chart in USD – Goldcore provides the US's most accurate Gold Price Charts. Track the Price Movements of Gold Price for the last 10 years. What is the price of one gram of gold today? · Today, the spot price for a gold ounce is € and $ · The price for an ounce of GoldPremium is €. Our interactive gold prices chart shows you the gold price per ounce in USD, along with options to view the day moving average and day moving average. The recent source of annual London Market Prices is the average of the daily London PM Fix found on sotabook.ru This is the price most users quote. The. Year, U.S. Official Price (U.S. dollars per fine ounce end of year). , , , , , , A look back at the variations in the price of gold in the 20th century, from the gold standard to the current health crisis. The chart illustrates the price of gold from to In contrast to the previous decade's stability, the price saw a gradual increase throughout this.

Contractor Tax Deductions

This is known as self-employment tax. In some cases, they may be able to deduct the employer-equivalent portion of the tax on their annual return. Can an. Instead, contractors must pay their own taxes through estimated quarterly payments. This status allows for various deductions, such as home office expenses. What Are the Best Deductions for Independent Contractors? · 1. Occupational Operating Expenses · 2. Supplies and Materials · 3. Home Office · 4. Snacks and Coffee. pay % more in Medicare taxes. There are 2 income tax deductions that reduce your taxes. First, your net earnings from self-employment are reduced by half. Check out these 10 tax deductions and start tracking them today to lower your expenses when tax season rolls around. After the relevant deductions have been applied the contractor will take the 35% reduction from gross leaving him with his taxable base. The contractor will. What taxes can independent contractors deduct? · 1. Self-employment tax deduction · 2. Home office expenses · 3. Travel expenses · 4. Advertising and marketing. If you are an independent contractor / self employed, have you written off any 3d softwares from your tax? What else were you able to claim? Independent contractor taxes: Important concepts · Deduction for one half of self-employment tax · Self-employed health insurance deduction · Qualified Business. This is known as self-employment tax. In some cases, they may be able to deduct the employer-equivalent portion of the tax on their annual return. Can an. Instead, contractors must pay their own taxes through estimated quarterly payments. This status allows for various deductions, such as home office expenses. What Are the Best Deductions for Independent Contractors? · 1. Occupational Operating Expenses · 2. Supplies and Materials · 3. Home Office · 4. Snacks and Coffee. pay % more in Medicare taxes. There are 2 income tax deductions that reduce your taxes. First, your net earnings from self-employment are reduced by half. Check out these 10 tax deductions and start tracking them today to lower your expenses when tax season rolls around. After the relevant deductions have been applied the contractor will take the 35% reduction from gross leaving him with his taxable base. The contractor will. What taxes can independent contractors deduct? · 1. Self-employment tax deduction · 2. Home office expenses · 3. Travel expenses · 4. Advertising and marketing. If you are an independent contractor / self employed, have you written off any 3d softwares from your tax? What else were you able to claim? Independent contractor taxes: Important concepts · Deduction for one half of self-employment tax · Self-employed health insurance deduction · Qualified Business.

There are numerous tax deductions independent contractors can make. Write-offs are deductible expenses the government allows that can help reduce tax. 10 Can I deduct payments to subcontractors? Yes. Payments made by a contractor to subcontractors, may be deducted from gross contracting income subject to the. Employee wages are exempt from gross receipts tax. We accept the determination of the Internal Revenue Service regarding your status as an independent. Tax Planning Tips for Independent Contractors · Tracking profits and expenses each month can help you properly estimate quarterly tax payments. · The IRS and. Generally, you must withhold and deposit income taxes, social security taxes and Medicare taxes from the wages paid to an employee. Also known as a tax write-off, the tax law defines a tax deduction as “any ordinary and necessary expense” incurred to carry on any trade or business. Eligible. Purchases tax free building materials, supplies and ;equipment placed in its inventory for resale · Provides the supplier with a valid sales tax exemption. This page will help you file your taxes as an independent contractor or an employee Report the amount of the self-employment tax deduction on Part I, Section. Certain deductions may be taken when computing the business tax. These deductions include, but are not limited to, cash discounts, trade-in amounts, amounts. This guide will provide you with all the essential information you need to know about tax deductions and how to take advantage of them. The good news is that you get to write off half of the self-employment tax that you pay. Plus, you don't have to itemize deductions on your federal income tax. Your construction company can write off the rental or lease payments for any equipment it rents or leases during the fiscal year if that equipment is used. It is favorable to hire independent contractors since you are not required to pay employer payroll taxes on their earnings or provide other benefits. filers can deduct costs for business taxes and licenses. Examples include business licenses, LLC or incorporation fees, and special accreditations. However. The contractor is still required to collect sales tax on the total contract price from their customer based on the job site location. When completing the excise. ♀️ A bodybuilder can write off the body oil they use in competitions; A junkyard owner can claim the cost of dog food, to feed the security dogs they bought. How Do I Deduct Independent Contractor Expenses From My Business Taxes? The first step in deducting independent contractor expenses from your business taxes. Tax deductions for independent contractors · Advertising expense · Car and truck expenses · Commissions and fees · Contract labor · Depreciation · Health insurance . filers can deduct costs for business taxes and licenses. Examples include business licenses, LLC or incorporation fees, and special accreditations. However. You can only choose one self employment tax deductions option out of these two. The standard deduction is a flat amount the IRS sets and is adjusted yearly.

Odfl Stock Price Today

Real time Old Dominion Freight Line (ODFL) stock price quote, stock graph, news & analysis. Get Old Dominion Freight Line Inc (ODFL.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. Old Dominion Freight Line Inc ODFL:NASDAQ ; Close. quote price arrow up + (+%) ; Volume. , ; 52 week range. - Is Old Dominion Freight Line (NASDAQ:ODFL) a buy? Compare the latest price, visualised quantitative ratios, annual reports, historical dividends. 30 days, $, $, Wednesday, 29th May ODFL stock ended at $ This is % less than the trading day before Tuesday, 28th May During. According to 18 analysts, the average rating for ODFL stock is "Hold." The month stock price forecast is $, which is a decrease of % from the. Discover historical prices for ODFL stock on Yahoo Finance. View daily, weekly or monthly format back to when Old Dominion Freight Line, Inc. stock was. What Is the Old Dominion Freight Line Inc Stock Price Today? The Old Dominion Freight Line Inc stock price today is What Is the Stock Symbol for Old. What is Old Dominion Freight Line, Inc. stock price today? The current price of ODFL is USD — it has increased by % in the past 24 hours. Watch. Real time Old Dominion Freight Line (ODFL) stock price quote, stock graph, news & analysis. Get Old Dominion Freight Line Inc (ODFL.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. Old Dominion Freight Line Inc ODFL:NASDAQ ; Close. quote price arrow up + (+%) ; Volume. , ; 52 week range. - Is Old Dominion Freight Line (NASDAQ:ODFL) a buy? Compare the latest price, visualised quantitative ratios, annual reports, historical dividends. 30 days, $, $, Wednesday, 29th May ODFL stock ended at $ This is % less than the trading day before Tuesday, 28th May During. According to 18 analysts, the average rating for ODFL stock is "Hold." The month stock price forecast is $, which is a decrease of % from the. Discover historical prices for ODFL stock on Yahoo Finance. View daily, weekly or monthly format back to when Old Dominion Freight Line, Inc. stock was. What Is the Old Dominion Freight Line Inc Stock Price Today? The Old Dominion Freight Line Inc stock price today is What Is the Stock Symbol for Old. What is Old Dominion Freight Line, Inc. stock price today? The current price of ODFL is USD — it has increased by % in the past 24 hours. Watch.

Today ; Last. ; Volume. k ; $ Chg. ; % Chg. % ; Open.

Average Price Target ; High $ ; Average $ ; Low $ View Old Dominion Freight Line, Inc ODFL investment & stock information. Get the latest Old Dominion Freight Line, Inc ODFL detailed stock quotes. Stock analysis for Old Dominion Freight Line Inc (ODFL:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company. Today's High is the highest price at which the stock has been traded that day Old Dominion Freight Line, Inc. shares are traded on the Nasdaq stock exchange. Old Dominion Freight Line Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Logo for stock ODFL (Old Dominion Freight Line). Amount. £. GBP. Latest price. $ (£ = $). Number of shares (est.) Start investing today. Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. Latest After-Hours Trades -> ; After Hours Time (ET). After Hours Price. After Hours Share Volume ; $ 14 ; $ 1 ; $ How much percentage Old Dominion Freight Line Inc. is up from its 52 Week low? Old Dominion Freight Line Inc. (ODFL) share price is $ It is up by 1% from. What is Old Dominion Freight Line Inc(ODFL)'s stock price today? The current price of ODFL is $ · When is next earnings date of Old Dominion Freight Line. Discover real-time Old Dominion Freight Line, Inc. Common Stock (ODFL) stock prices, quotes, historical data, news, and Insights for informed trading and. Historical Prices for Old Dominion Freight Line ; 08/08/24, , , , ; 08/07/24, , , , View Old Dominion Freight Line, Inc. ODFL stock quote prices, financial information, real-time forecasts, and company news from CNN. The current share price for Old Dominion Freight Line (ODFL) stock is $ for Thursday, August 22 , down % from the previous day. Previous Close ; Week High/Low ; Volume , ; Average Volume 1,, ; Price/Earnings (TTM) Based on 16 Wall Street analysts offering 12 month price targets for Old Dominion Freight in the last 3 months. The average price target is $ with a high. Old Dominion Freight Line Share Price Live Today:Get the Live stock price of ODFL Inc., and quote, performance, latest news to help you with stock trading. Price History & Performance ; 52 Week Low, US$ ; Beta, 1 ; 11 Month Change, % ; 3 Month Change, %. Historical daily share price chart and data for Old Dominion Freight Line since adjusted for splits and dividends. The latest closing stock price for. (NASDAQ: ODFL) Old Dominion Freight Line stock price per share is $ today (as of Aug 16, ). What is Old Dominion Freight Line's Market Cap? (NASDAQ.

Top 5 Banks For Checking Accounts

Find the best account for you · Checkless banking with no overdraft fees · Most flexible banking options with check writing and digital payments · Discounts on. Best Checking Accounts – September ; Quontic High Interest Checking · · % ; Axos Bank Rewards Checking · · % ; Discover Cashback Debit · · %. Most people will be well served with any Discover, Capital One or Alliant. They seem to be three of the best online checking accounts and frequently. Transform the way you manage your money with Starling Bank. Enjoy personal and business banking online and at your fingertips, always. Apply in minutes. Mountain America Credit Union. Credit Union, High Yield Money Market Account, Seniors ; Navy Federal. Credit Union, Overall ; PNC. National Bank, Checking/Savings. Grow your business or non-profit. We have everything you need. Free financial planning, checking accounts 5 stars. Five star rated for financial safety and. Explore checking account options designed to fit your changing needs. Open a Bank of America Advantage Banking account online today. Axos' Essential Checking account comes with no monthly, annual or overdraft fees. An Axos representative told TPH all its checking accounts require a $ Top 10 Checking Accounts for Seniors · 1. Chase Bank · 2. US Bank · 3. BB&T Bank · 4. Northpointe Bank · 5. Consumers Credit Union · 6. One American Bank · 7. Lake. Find the best account for you · Checkless banking with no overdraft fees · Most flexible banking options with check writing and digital payments · Discounts on. Best Checking Accounts – September ; Quontic High Interest Checking · · % ; Axos Bank Rewards Checking · · % ; Discover Cashback Debit · · %. Most people will be well served with any Discover, Capital One or Alliant. They seem to be three of the best online checking accounts and frequently. Transform the way you manage your money with Starling Bank. Enjoy personal and business banking online and at your fingertips, always. Apply in minutes. Mountain America Credit Union. Credit Union, High Yield Money Market Account, Seniors ; Navy Federal. Credit Union, Overall ; PNC. National Bank, Checking/Savings. Grow your business or non-profit. We have everything you need. Free financial planning, checking accounts 5 stars. Five star rated for financial safety and. Explore checking account options designed to fit your changing needs. Open a Bank of America Advantage Banking account online today. Axos' Essential Checking account comes with no monthly, annual or overdraft fees. An Axos representative told TPH all its checking accounts require a $ Top 10 Checking Accounts for Seniors · 1. Chase Bank · 2. US Bank · 3. BB&T Bank · 4. Northpointe Bank · 5. Consumers Credit Union · 6. One American Bank · 7. Lake.

PNC Bank offers a wide range of personal banking services including checking and savings accounts, credit cards, mortgage loans, auto loans and much more. Bank5 Connect is an online-only bank offering high-interest checking accounts As one of America's top-rated online banks, we deliver exceptional value to our. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». The bank has mixed reviews on Trustpilot and a middling overall score of out of 5 stars. Pros. Strong APY; No minimum deposit required; No monthly service. Best Checking Accounts – September ; Quontic High Interest Checking · · % ; Axos Bank Rewards Checking · · % ; Discover Cashback Debit · · %. The main difference between checking and savings accounts is that checking accounts Most banks won't allow people under the age of 18 to open a. We're your community bank for savings accounts, checking, mortgages, HELOCs, personal & auto loans and wealth management. Enjoy our top-tier financial. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. Checking and savings accounts, credit cards Skip to main content. Truist Homepage. Open Account. Featured accounts · Banking accounts · Savings accounts. Credit unions and banks offer a multitude of financial accounts—each one serving a different purpose and offering varying benefits. Mountain America Credit Union. Credit Union, High Yield Money Market Account, Seniors ; Navy Federal. Credit Union, Overall ; PNC. National Bank, Checking/Savings. Deposit checks. If you do get a check from your employer (or anyone else), many banks allow you to deposit it straight into your checking account via your. Find the best checking account for your finances with Fifth Third Bank A 5% cash advance fee will be assessed for each advance during the first Amer Best Banks SQ Color RGB Nwswk Horiz RGB. Home. We're a full-service financial institution, offering all the things much bigger banks offer. But we also. Checking Accounts · Neighborhood Rewards Checking · Main Street Checking · Main Street Interest Checking · BankOn Main Street Checking · Notice to Accountholders Safe Debit Account. Why you'll love it: You'll skip the checks but want the tools to help manage your money and build your. To apply online, just select the appropriate link from the top of this page and find the account you wish to open. We will limit to 5 the number of. Access your money & bank almost anywhere with our top-rated mobile app. No 5 transactions per month. The daily limit is $ You must immediately. If your account is with an FDIC-insured bank, federal law limits your loss in the event of an unauthorized online transaction. 5. You have access to other. Checking Accounts Main Page · Confidence Checking · Account Comparisons · Order First Commonwealth Bank proudly offers top local banking solutions in our.

Tax Laws On Selling Your Home

:max_bytes(150000):strip_icc()/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

If you owned and lived in your home for two of the last five years before the sale, then up to $, of profit may be exempt from federal income taxes. If. Capital gains tax rates vary depending on the length of time the property was owned and the seller's income bracket, with long-term gains generally taxed at. There's an exclusion on gains from the sale of a primary residence, which generally lets sellers exclude up to $, in gains from their income (or $, The gains that you realize on the sale of your “second” or vacation home are typically exempt from capital gains taxes as well. Under the current tax laws, any. In the U.S., you are taxed on the capital gain any time you sell at asset at a profit, which includes houses. · There are two exceptions to the. And you may have to pay taxes on your capital gain in the form of capital gains tax. Just as you pay income tax and sales tax, gains from your home sale are. This deduction is capped at $10,, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct. If you sell your home, you may exclude up to $ of your capital gain from tax ($ for married couples), but you should learn the fine print first. If you live in a house for two of the previous five years, you owe little or no taxes on its sale. Knowing the tax laws can make a considerable difference. If you owned and lived in your home for two of the last five years before the sale, then up to $, of profit may be exempt from federal income taxes. If. Capital gains tax rates vary depending on the length of time the property was owned and the seller's income bracket, with long-term gains generally taxed at. There's an exclusion on gains from the sale of a primary residence, which generally lets sellers exclude up to $, in gains from their income (or $, The gains that you realize on the sale of your “second” or vacation home are typically exempt from capital gains taxes as well. Under the current tax laws, any. In the U.S., you are taxed on the capital gain any time you sell at asset at a profit, which includes houses. · There are two exceptions to the. And you may have to pay taxes on your capital gain in the form of capital gains tax. Just as you pay income tax and sales tax, gains from your home sale are. This deduction is capped at $10,, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct. If you sell your home, you may exclude up to $ of your capital gain from tax ($ for married couples), but you should learn the fine print first. If you live in a house for two of the previous five years, you owe little or no taxes on its sale. Knowing the tax laws can make a considerable difference.

First, the property you're selling must be your principal residence. That means you live in it. This tax break doesn't apply to a house or other property that. Understanding Capital Gains Tax: Capital gains taxes are fees that real estate investors must pay after selling a property. They are calculated based on the. Anything you want to deduct must have been done 90 days before you sold your house. The IRS thinks that three months is enough time to do any repairs related to. A capital gain is the difference between the “basis” in property and its selling price. The basis is usually the purchase price of property. So, if you. Could you owe capital gains tax on your home? There's an exclusion on gains from the sale of a primary residence, which generally lets sellers exclude up to. Then, if you qualify for an exemption, subtract the amount. What's left is the amount of money you 're going to need to pay tax on capital gains. Property Taxes. If you sell your house, you and your spouse can each exclude the first $, of gain from your taxable income. The capital gains exclusion applies only to. I sold my principal residence this year. What form do I need to file? If you meet the ownership and use tests, the sale of your home qualifies for exclusion. Homeowners who sell their home within two years of buying it may face a hefty tax penalty known as capital gains tax. If you're planning to sell your home, it's important to know about capital gains tax so you do not get hit with any tax surprises when you file your return. Selling a home is a major life milestone that may come with a large tax liability. · Qualified single taxpayers can generally exclude $, of profit when. You may not have to pay any federal income tax on your house sale thanks to a significant capital gains exclusion, but not everyone qualifies. Here's what you. We do, however, allow a deduction or credit based on local real estate taxes paid. Resident homeowners may be entitled to property tax credits or deductions on. In addition, sellers must pay taxes on any capital gains associated with the sale, which are taxed at either a short-term rate for homes held for one year or. In the U.S., you are taxed on the capital gain any time you sell at asset at a profit, which includes houses. · There are two exceptions to the. In most instances you can can sell your primary residence without incurring any tax liability. You can make up to $, in profit if you're a single. Understanding Capital Gains Tax: Capital gains taxes are fees that real estate investors must pay after selling a property. They are calculated based on the. Under the current law, you don't need to invest in another home in order to defer capital gain liability, as was the case previously. Even if you sell your home. In most instances you can can sell your primary residence without incurring any tax liability. You can make up to $, in profit if you're a single. If you owned and lived in your home for two of the last five years before the sale, then up to $, of profit may be exempt from federal income taxes. If.

657 Credit Score Auto Loan Rate

What's the Average Credit Score to Finance a Car? The average credit score of drivers who have procured auto loans as of was for a new vehicle and Start by checking your credit history and note the score. The higher the credit score, the lower your interest rate will be. So, what is a good car loan rate? Monthly payment: $ ; Purchase price. Must be between $0 and $1,, ; Down payment · Must be between $0 and $, ; Loan term · Must be between 1 and You can get a vehicle with a wide range of credit scores, but the average for a new vehicle is and the average for a used vehicle is Bad credit car. Average Credit Score Needed to Finance a Car. In , the average credit score of drivers who applied for a new car loan was and for a used car loan. If the credit score you're talking about is an Experian FICO score, then a mid score is considered fair. You will be offered interest rates. People with credit scores below receive more than 40% of all auto loans. Still, it's important to compare your auto loan options carefully if you want to. What auto loan rate would I qualify for with a credit score of ? while thе аvеrаgе сrеdіt score needed for a new-car loan was. Ongoing Credit Monitoring Track your FICO Score & identity · One The size of your monthly payment depends on loan amount, loan term, and interest rate. What's the Average Credit Score to Finance a Car? The average credit score of drivers who have procured auto loans as of was for a new vehicle and Start by checking your credit history and note the score. The higher the credit score, the lower your interest rate will be. So, what is a good car loan rate? Monthly payment: $ ; Purchase price. Must be between $0 and $1,, ; Down payment · Must be between $0 and $, ; Loan term · Must be between 1 and You can get a vehicle with a wide range of credit scores, but the average for a new vehicle is and the average for a used vehicle is Bad credit car. Average Credit Score Needed to Finance a Car. In , the average credit score of drivers who applied for a new car loan was and for a used car loan. If the credit score you're talking about is an Experian FICO score, then a mid score is considered fair. You will be offered interest rates. People with credit scores below receive more than 40% of all auto loans. Still, it's important to compare your auto loan options carefully if you want to. What auto loan rate would I qualify for with a credit score of ? while thе аvеrаgе сrеdіt score needed for a new-car loan was. Ongoing Credit Monitoring Track your FICO Score & identity · One The size of your monthly payment depends on loan amount, loan term, and interest rate.

The average credit score to finance a car is for a new vehicle and for a pre-owned vehicle. Many Omaha drivers can qualify for bad credit car financing. vehicle and for a gently-used vehicle in Typically, the better your credit score, the lower your interest rate will be for your monthly payments. We have a huge network of lenders we work with, which allows us to get you the best car loan rate your credit score allows Main:() ; Sales. By June, it was %. The rate you pay will depend on the lender and your credit score. And secured personal loans may come with lower rates than unsecured. is tier 3 credit- but if you wanted to get a lower rate you can the subvented rate. That means Toyota Financial is buying down the rate. So. First, if possible, it's a good idea to tune up your credit score before applying for a car loan. interest rate. Here are some additional questions to. car loan despite your credit score will help. Show Collateral: If you own a auto financing and get a good interest rate to boot. Explore Your Auto. Input your home zip code to check eligibility. powered by LendingTree. Auto Loan Rates icon Auto Loan Rates. Auto Loan Rates icon Auto Loan Rates. Compare. It may be difficult to obtain a year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates. credit and loans, at better interest rates. The best approach to improving Among consumers with FICO® credit scores of , the average utilization rate is. credit levels, though some may charge higher interest rates. Before you give up on car financing, find out what credit score is needed to finance a car so. Deep subprime loan at % (new) or % (used). As you can see, a credit score puts you in the “good” or “prime” category for financing. There are lenders who work with a variety of credit levels, though some may charge higher interest rates. vehicle and for a used car. However, you. So a score of is typically the minimum credit score you'll need to get a favorable car loan. Favorable is important here because you can get a car loan. Those with a score in the next highest tier of to qualified for an average new car loan interest rate of % and an average used car rate of %. Car. The average credit score to finance a car is for a new vehicle and for a pre-owned vehicle. Many drivers in Winthrop will qualify for bad credit car. In most cases, for drivers who have obtained an auto loan in , the average credit score for acceptance is for a new vehicle and for a used car. Bad. A Higher FICO® Score Saves You Money ; FICO Score, APR, Monthly Payment ; , % ; , % ; , %. Car loan rates by credit score; Types of scores reviewed by dealerships; Ways to help get you approved for a car loan; How to build your credit before car.

Smartphone For Office Use

The Jitterbug Smart4 is intended to be an easy-to-use smartphone, and the The apps work well, although in some cases they are not easy to navigate. It's the only flip phone with Amazon Alexa, so you can make calls and send texts using just your voice. And for help in emergencies, the Urgent Response button. 1. Samsung Galaxy Note20 Ultra: It has a large display, S Pen support, excellent battery life, and business-friendly features. · 2. Apple iPhone. I've since reviewed multiple generations of flagship and affordable handsets, so while my day-to-day work testing televisions and surround-sound systems means I. Connect with customers effortlessly · Get numbers for any use case · Calls and texts in one unified view · Contact details all in one place. Take the network challenge. Whether you run a one-person show or a large enterprise, you can try America's largest and fastest 5G network FREE for. Top 3: Best Phones for Business of · 1) iPhone 15 Pro Max – Overall Best Mobile Phone for Business · 2) Samsung Galaxy S24 Ultra – The Best Android Phone. Smartphones are used by consumers and as part of a person's business or work. They provide access to many mobile applications and computing functions, and have. This can makes choosing the most robust smartphone for business use a little tricky. Both platforms offer great support for Microsoft Office and Exchange. The Jitterbug Smart4 is intended to be an easy-to-use smartphone, and the The apps work well, although in some cases they are not easy to navigate. It's the only flip phone with Amazon Alexa, so you can make calls and send texts using just your voice. And for help in emergencies, the Urgent Response button. 1. Samsung Galaxy Note20 Ultra: It has a large display, S Pen support, excellent battery life, and business-friendly features. · 2. Apple iPhone. I've since reviewed multiple generations of flagship and affordable handsets, so while my day-to-day work testing televisions and surround-sound systems means I. Connect with customers effortlessly · Get numbers for any use case · Calls and texts in one unified view · Contact details all in one place. Take the network challenge. Whether you run a one-person show or a large enterprise, you can try America's largest and fastest 5G network FREE for. Top 3: Best Phones for Business of · 1) iPhone 15 Pro Max – Overall Best Mobile Phone for Business · 2) Samsung Galaxy S24 Ultra – The Best Android Phone. Smartphones are used by consumers and as part of a person's business or work. They provide access to many mobile applications and computing functions, and have. This can makes choosing the most robust smartphone for business use a little tricky. Both platforms offer great support for Microsoft Office and Exchange.

Note: Using a Chromebook? You can install Office mobile apps for Android on your Chromebook if you have the Google Play Store or use Office Online if you have. Remote work: If you have remote employees or staff members who work outside the office regularly, offering a company phone helps them stay connected. · Job. business use. The cameras on smartphones can be used to photograph documents and send them via email or messaging in place of using fax (facsimile) machines. Comcast Business Internet required. Reduced speeds after use of monthly data included with your data option. Data thresholds and actual savings vary. Find the right phone to level up your business productivity–from foldables, to rugged phones, to affordable smartphones with all the essentials. HONOR offers durable business phones with generous screen sizes and long-lasting battery life for the modern multi-tasker. HONOR business phones. Fairphone logo. AT&T Office@Hand simplifies business communications by working seamlessly across desk phones, smartphones, PCs, tablets, and other devices. Work from anywhere. How you intend to use your smartphone should factor into your device choice. For example, if you're a freelance videographer who purchased a high-end iMac to. Softphones, or software phones, can be designed with critical business features, including multi-party videoconferencing, business voicemail, call recording. Discover the latest in electronic & smart appliance technology with Samsung. Find the next big thing from smartphones & tablets to laptops & tvs & more. Introducing the new iPhone 16 Pro On Us. Put incredible power to work on America's largest and fastest 5G network. Plus, business plans that include over $ Choosing a smartphone for your business Most smartphones are as powerful and flexible as a personal computer – sometimes, more so. This makes it possible for. Smartphones enable people to work during their leisure time, as well as facilitating private communication in the workplace. Colleagues will soon be able to. 3//8 and E/CN.3//27) provide additional background to the work of the task teams. Mobile phones are used by large parts of the population in all. Freedom of movement:turning your smartphone into a mobile office will allow you to be free to move. That means, you can work from anywhere, while on public. Most people already own a smartphone, and using it for business could save you laptop costs. For many, working from a cell phone may be preferable to running a. Remote work: If you have remote employees or staff members who work outside the office regularly, offering a company phone helps them stay connected. · Job. You can often break down usage statistics by filters, such as by employee or department. Nextiva reporting. Business phone systems include various reports and. As we move up the ranks at work into leadership positions, communication becomes a core part of our roles. Being able to align my team on a. Note: Using a Chromebook? You can install Office mobile apps for Android on your Chromebook if you have the Google Play Store or use Office Online if you have.

How To Sue Uber Eats

Use your Uber account to order delivery from Sue Bites Bar in Amsterdam. Browse the menu, view popular items, and track your order. I ordered food on Uber eats. The order was paid for by $15 Uber cash and $ from my credit card. The food never arrived. As a driver for Uber Eats, you possess the same legal right to sue another motorist as any other driver if they are shown liable for causing an accident. You could contact Uber Eats customer service, file a complaint with the BBB or FTC, and bring a claim to the small claims court if all fails. When Uber Eats customer service isn't giving you a fair resolution, these are your legal options to file a claim against Uber Eats. Uber Eats agreed to pay $ million as part of a class action lawsuit settlement to resolve claims that it violated the rights of prospective drivers in New. Does your case qualify for small claims court? · Send Uber your demand letter. · Fill out your court forms. · File your complaint with your court. · “Serve” your. Uber Eats agreed to pay $ million as part of a class action lawsuit settlement to resolve claims that it violated the rights of prospective drivers in New. As an Uber Eats driver, you have the same right as any other motorist to sue the opposing driver if they caused the accident. Uber Eats also has uninsured/. Use your Uber account to order delivery from Sue Bites Bar in Amsterdam. Browse the menu, view popular items, and track your order. I ordered food on Uber eats. The order was paid for by $15 Uber cash and $ from my credit card. The food never arrived. As a driver for Uber Eats, you possess the same legal right to sue another motorist as any other driver if they are shown liable for causing an accident. You could contact Uber Eats customer service, file a complaint with the BBB or FTC, and bring a claim to the small claims court if all fails. When Uber Eats customer service isn't giving you a fair resolution, these are your legal options to file a claim against Uber Eats. Uber Eats agreed to pay $ million as part of a class action lawsuit settlement to resolve claims that it violated the rights of prospective drivers in New. Does your case qualify for small claims court? · Send Uber your demand letter. · Fill out your court forms. · File your complaint with your court. · “Serve” your. Uber Eats agreed to pay $ million as part of a class action lawsuit settlement to resolve claims that it violated the rights of prospective drivers in New. As an Uber Eats driver, you have the same right as any other motorist to sue the opposing driver if they caused the accident. Uber Eats also has uninsured/.

We've established processes to identify riders and Uber Eats users who abuse our ratings or customer support systems, often with the aim of getting a refund. Uber's records show that you used the Uber Rides App as a driver in California between February 28, , and December 16, or the Uber EATS App in. Major food delivery platforms are no strangers to lawsuits. For example, Grubhub Inc., DoorDash, and Uber Eats have all sued the City of New York as plaintiffs. Have your favorite Arctic Sue restaurant food delivered to your door with Uber Eats. Whether you want to order breakfast, lunch, dinner, or a snack. Report the issue with your order to Uber Eats immediately · Contact customer service · Make a formal request for a refund · Keep records of any communication. It's a dispute between you and Uber. They could take you to court to collect the debt or they can refuse to provide future services to you until. Uber uses software to detect accounts that might be engaging in fraudulent activity. Then, a specialised team manually reviews each case. Who Can I Sue In An Uber Eats Slip And Fall Accident? There may be another party who is responsible in your Uber Eats slip and fall accident and this is the. Uber Eats Insurance: An Uber Eats policy includes a $50, limit per sue – you may be able to recover substantial financial compensation for any. Uber Eats Insurance: An Uber Eats policy includes a $50, limit per sue – you may be able to recover substantial financial compensation for any. Absolutely, if an Uber Eats driver is responsible for a collision and you suffer injuries as a result of it, then you can sue both the individual delivery. Yes, if an Uber Eats delivery driver causes an accident, you have the right to sue the at-fault party or parties. If you are hurt in the collision, both Uber. Call us for free consultations and let us help you. You can reach our UberEATS accident lawyers at () for our offices in Miami, Fort Lauderdale, and. We've established processes to identify riders and Uber Eats users who abuse our ratings or customer support systems, often with the aim of getting a refund. You can sue DoorDash, Grubhub, Postmates, Uber Eats, and all other companies if you suffered an injury due to the negligence of a food delivery driver. Under. If you've been hit by an Uber Eats driver, speak with a San Antonio Uber Eats delivery driver accident lawyer now Can I sue if an Uber Eats driver injures me. Uber Eats could be sued in cases of gross negligence. Can You Sue the Property Owner? If you were injured while picking up a food order at a restaurant or while. Use your Uber account to order delivery from Sue's Burgers and Shakes in Brisbane. Browse the menu, view popular items and track your order. Our attorneys are also investigating a class action lawsuit on behalf of UberEats drivers. Some lawsuits have already been filed. A class action lawsuit has. Beware of anyone who offers to help you file a claim for the Lyft or Uber settlements. Phone numbers, caller ID, and email addresses can be faked to appear to.

How Do You Deter Flies

Plant this herb wherever you see fit to keep those pesky bugs away. Perfect potted in-between your flowers and veggies, basil adds a fresh garden feel to any. How To Get Rid of Flies On my Porch · Citronella-infused incense and candles. · Plant nice herbs around your porch · Use essential oils after cleaning the porch. Simply half fill a clear plastic bag with water. Close it with a rubber band and just hang it anywhere flies are a problem. They'll stay away. To effectively eliminate flies outdoors, you can use various garden plants known for their fly-repelling properties. Basil, Bay Leaf, Lavender, Nasturtiums. To get rid of house flies you can use several methods, including a natural fly repellent. You can even manage to stop the problem before there is one. 1. Fly Swatter: A Fly swatter is a cheap method to keep flies at bay in your house. Fly swatters now come with an electronic machine these days that traps the. Citrus spray (but NOT degreaser. It's toxic to pets) around the door will discourage mosquitoes. They hate the stuff. For cluster flies, treat upper stories of building exteriors immediately before the flies move indoors for overwintering. Permethrin is currently the most. Vinegar and dish soap fly trap · Use a shallow dish bowl and fill it with an inch of apple cider vinegar and a tablespoon of sugar. · Next, add some fruit-. Plant this herb wherever you see fit to keep those pesky bugs away. Perfect potted in-between your flowers and veggies, basil adds a fresh garden feel to any. How To Get Rid of Flies On my Porch · Citronella-infused incense and candles. · Plant nice herbs around your porch · Use essential oils after cleaning the porch. Simply half fill a clear plastic bag with water. Close it with a rubber band and just hang it anywhere flies are a problem. They'll stay away. To effectively eliminate flies outdoors, you can use various garden plants known for their fly-repelling properties. Basil, Bay Leaf, Lavender, Nasturtiums. To get rid of house flies you can use several methods, including a natural fly repellent. You can even manage to stop the problem before there is one. 1. Fly Swatter: A Fly swatter is a cheap method to keep flies at bay in your house. Fly swatters now come with an electronic machine these days that traps the. Citrus spray (but NOT degreaser. It's toxic to pets) around the door will discourage mosquitoes. They hate the stuff. For cluster flies, treat upper stories of building exteriors immediately before the flies move indoors for overwintering. Permethrin is currently the most. Vinegar and dish soap fly trap · Use a shallow dish bowl and fill it with an inch of apple cider vinegar and a tablespoon of sugar. · Next, add some fruit-.

Oils like lavender, mint, lemongrass, clove, rosemary and eucalyptus may help in repelling flies.

If you're looking for a fly repellent, lemongrass oil has proven to be particularly effective. A clinical study found that flies spent significantly less time. Combine vinegar and dish soap in a cup or bowl and cover it with plastic wrap. Poke holes in the wrap. Flies will be attracted to the vinegar but will sink once. 1. Eliminate the breeding grounds. “Flies breed in decaying fruit and veggies, compost, and manure,” says Dr. Gabrielle Francis, a New York City-based. A space spray or a fogger is a good choice if you have a lot of fly activity inside and you need to get rid of the flies quickly. With this method, you will. How to Keep Flies Away Safely and Naturally · 1. Hang Bags of Water From Porches to Repel Flies · 3. Use Fly traps · 4. Install Yellow Light Bulbs to Keep Flies. They are effective deterrents for fruit flies. Cloves have a strong smell, which flies find irritating. The clove may be used alone or with a few apple pieces. Homemade fly repellent spray: A mixture of dish soap, water, baking soda, and vinegar can be filled into a spray bottle. The mixture should contain a few drops. Fill a transparent plastic bag with water, put in a couple of coins and hang it outside. Flies do not have pupils to regulate light in their eyes. So the idea. Basil, bay leaf, cedar, cinnamon, citrus, citronella, cloves, cucumber slices or peels, lavender, marigolds, mint, peppermint, pine, rosemary, and vanilla oils. What scents keep flies away? · Bay Leaves/Laurel Leaves · Camphor · Catnip · Cayenne Pepper · Cinnamon · Citronella · Citrus · Cloves. Cloves are known for. One common treatment uses cayenne pepper steeped in water as a spray treatment. Spritz in doorways and around windowsills and the sharp odor will keep the flies. To get rid of pesky flies outside, set up an oscillating fan near where you'll be hanging out. The strong breeze will blow away any flies that buzz by. You can. 1. Deter Flies With Pennies If flies are bugging your barbecue, fill a resealable clear plastic bag about 3/4 of the way with water and toss three pennies into. Here are some effective treatment methods: Traps: Because flies are attracted to food sources, commercial traps with food items can help trap flies. Most essential oils (tea tree oil, rosemary oil, lavender oil, peppermint oil, rose oil, and more) have strong odors that keep flies away. A blend of two or. Close your windows and doors. If you want to keep flies away from you and your room, then you should close your windows and doors, which can let in the flies. You can use fly traps, fly swatters, or insect repellent. Natural remedies such as essential oils and herbs may also be effective. Make your own cinnamon oil fly repellent by mixing milliliters of pure water with 10 drops of cinnamon essential oil. (This also works. Flies are repelled by vinegar, and the smell of boiling vinegar can make them leave. Pour some malt vinegar in a pot or pan, let it boil, and wait for the flies.